Insurance Solutions Tailored to Your Needs

From protecting your home to securing your business, Southern Oaks Insurance offers a wide range of coverage options designed to safeguard what matters most to you.

Comprehensive Coverage for Life’s Many Stages

We provide personalized insurance solutions to give you confidence and peace of mind, no matter your situation.

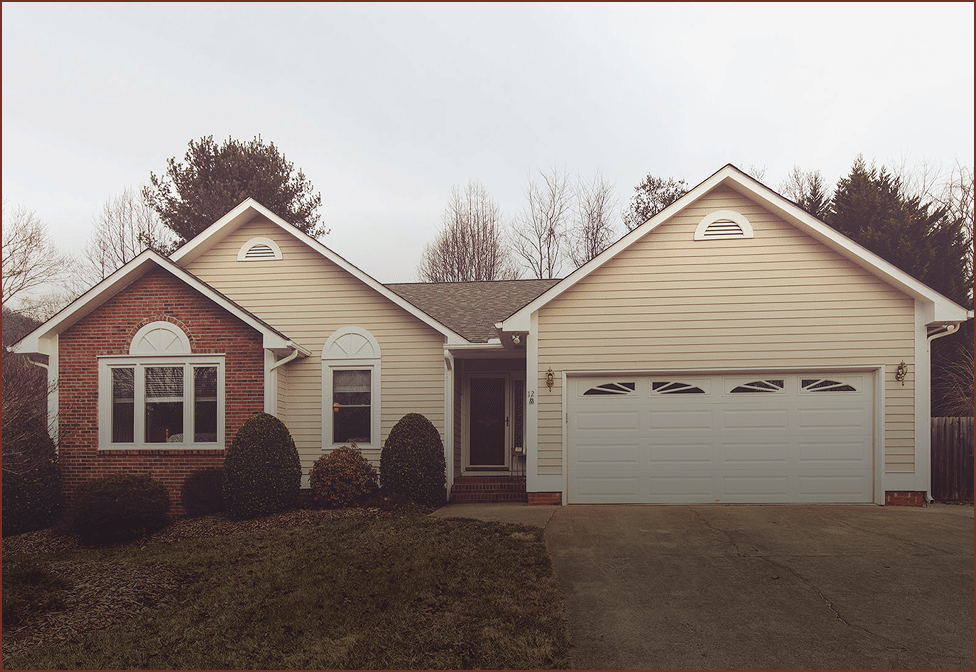

Home Insurance

Home insurance through Southern Oaks Insurance Services helps protect one of your most important investments. A properly structured home insurance policy can provide coverage for your home’s structure, personal belongings, and liability in the event of unexpected damage or loss. Common covered events may include fire, wind damage, theft, and other qualifying perils. In addition to protecting the physical home, many policies also include liability coverage to help cover medical or legal expenses if someone is injured on your property. Because every home and homeowner is different, Southern Oaks works closely with clients to review risks, coverage options, and policy limits to ensure proper protection. Optional endorsements may be available to help customize coverage based on your needs. With local knowledge and personalized service, Southern Oaks helps homeowners feel confident their coverage fits both their property and their budget.

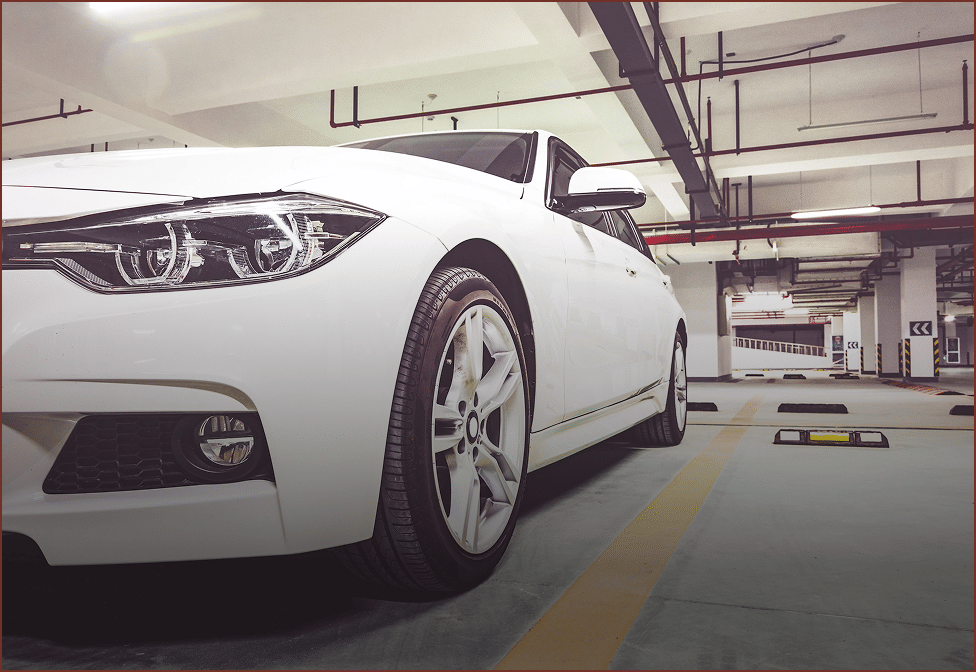

Personal Auto

Personal auto insurance from Southern Oaks Insurance Services is designed to protect you financially while on the road. Auto insurance typically includes liability coverage to help cover injuries or property damage caused to others, along with optional coverages such as collision and comprehensive insurance for your own vehicle. These options can help pay for repairs or replacement after accidents, weather damage, theft, or vandalism. Southern Oaks understands that every driver’s situation is different, whether you commute daily, insure multiple vehicles, or have new drivers in your household. Our team works with you to evaluate coverage needs, vehicle usage, and budget considerations.

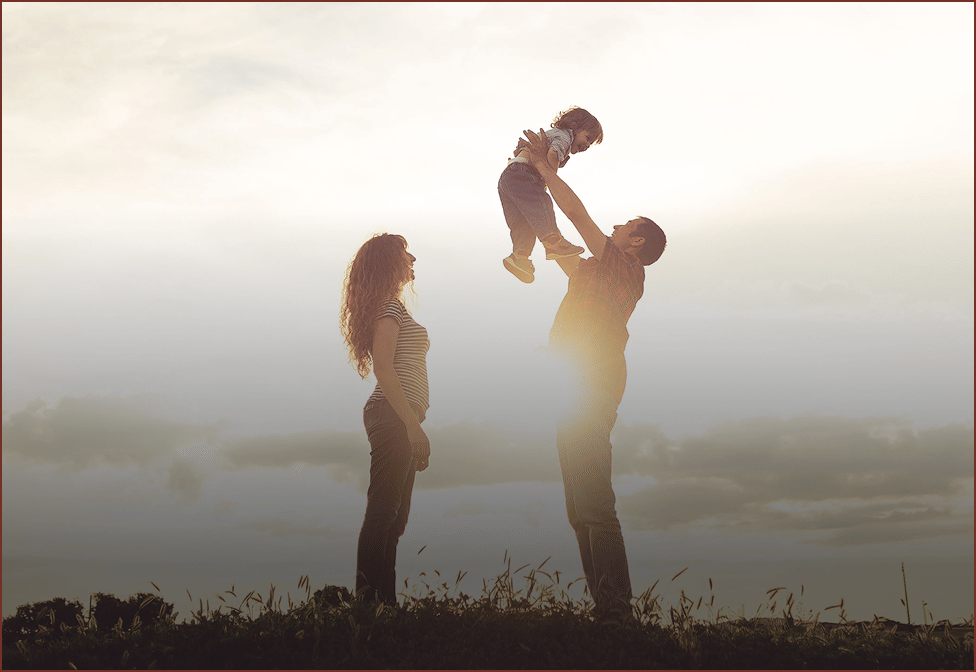

Life Insurance

Life insurance through Southern Oaks Insurance Services helps provide financial security for the people who matter most to you. Life insurance can help replace lost income, cover outstanding debts, pay funeral expenses, and offer long-term support for loved ones in the event of your passing. Policies are available in different forms, including term life insurance for coverage over a set period and permanent life insurance options that may provide lifelong protection and potential cash value growth. Choosing the right life insurance policy depends on your family situation, financial goals, and future plans. Southern Oaks takes the time to explain your options clearly so you can make informed decisions with confidence.

Commercial Auto

Commercial auto insurance from Southern Oaks Insurance Services is designed for vehicles used in business operations. Whether your business owns cars, trucks, vans, or specialty vehicles, commercial auto insurance helps protect against financial losses related to accidents, liability claims, theft, and property damage. Coverage may include liability protection for bodily injury or property damage caused by business vehicles, as well as physical damage coverage to repair or replace vehicles after covered incidents. Optional coverages such as uninsured motorist and medical payments coverage can add additional layers of protection for drivers and passengers. Commercial auto policies are structured differently than personal auto policies and take into account business-specific risks, vehicle usage, and driving exposure. Southern Oaks works with business owners to understand how vehicles are used and to build coverage that supports daily operations while managing risk.

Business Insurance

Business insurance through Southern Oaks Insurance Services helps protect companies from the many risks associated with operating a business. Coverage can help safeguard your property, equipment, inventory, and financial stability in the event of unexpected losses. Common policies may include general liability insurance to help protect against claims involving bodily injury or property damage, as well as commercial property coverage for buildings and business assets. Additional options such as business interruption coverage may help offset lost income if operations are temporarily disrupted due to a covered event. Every business faces unique risks based on its industry, size, and operations. Southern Oaks takes a personalized approach by assessing those risks and recommending coverage solutions that align with your goals and budget. With knowledgeable guidance and responsive service, we make sure business owners feel prepared, protected, and supported as they grow and operate with confidence.

Commercial Auto

Flood Insurance Flood insurance from Southern Oaks Insurance Services provides important protection against damage caused by flooding, which is typically not covered by standard home or business insurance policies. Flooding can result from heavy rainfall, storm surge, or rising water and may cause extensive damage to structures and contents. Flood insurance policies can include With proper flood insurance in place, homeowners and business owners can better protect their investment and reduce financial uncertainty when severe weather or flooding occurs.

More Than Policies — We Build Relationships

We take time to understand your needs, shop multiple carriers, and find coverage that offers the best value and protection.

- Independent agency with access to multiple insurance providers

- Personalized service from a local, experienced team

- Fast, no-obligation quotes

GET IN TOUCH

Let’s Find the Right Coverage for You

We’ll review your needs, explain your options, and find the perfect policy—no pressure, no obligation.